If you are a freelancer, independent contractor or small business owner, then you must be familiar with the term 1099. It is a form used by the Internal Revenue Service (IRS) in the United States to report payments made to non-employees. When a business hires workers to perform work, it must classify them as either employees or independent contractors. If the workers are classified as independent contractors, then the business is not required to withhold taxes or provide benefits. However, the business must report the payments made to the independent contractors to the IRS using a 1099 form.

1099 Forms Explained

There are several types of 1099 forms, each reporting different types of payments. In this post, we will discuss the most common types of 1099 forms.

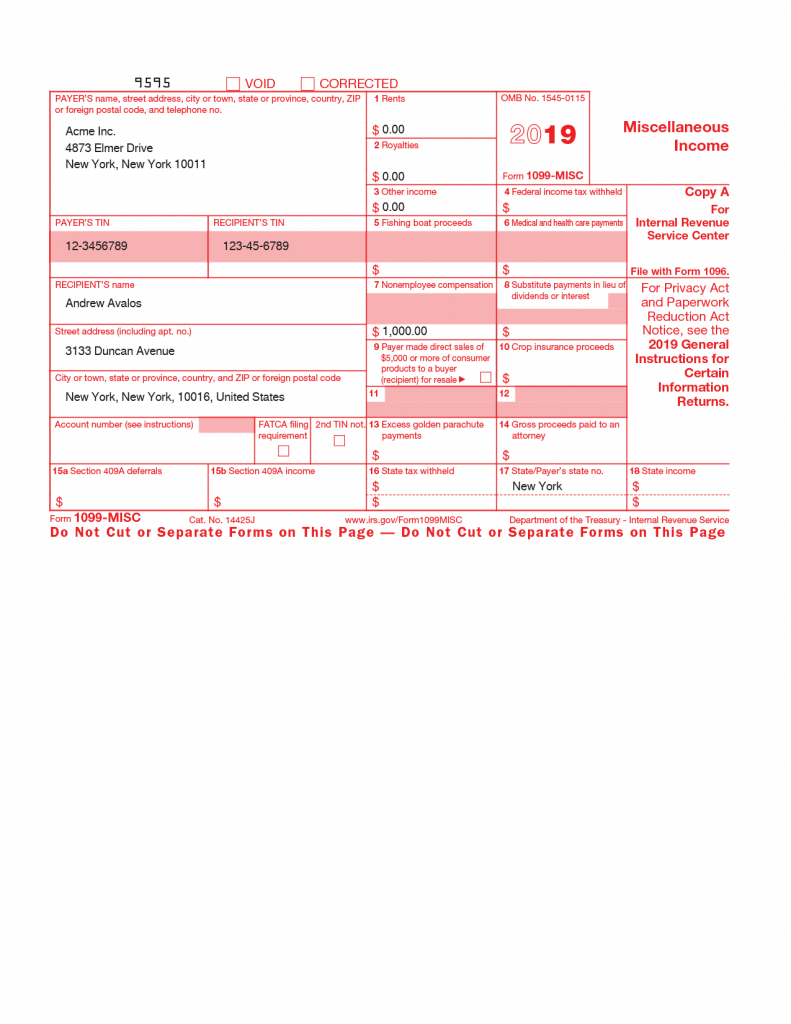

1099-MISC Form

The 1099-MISC form is used to report miscellaneous income paid to non-employees. Non-employee compensation refers to income paid to independent contractors and other non-employees for services provided to a business. This type of compensation can include fees, commissions, prizes, and awards. The 1099-MISC form is also used to report rent, royalties, and other types of income.

When you receive a 1099-MISC form, you must report the income on your tax return. The income reported on the 1099-MISC form is subject to self-employment tax, which is a tax on net earnings from self-employment. You must also pay federal income tax on the income reported on the 1099-MISC form.

When you receive a 1099-MISC form, you must report the income on your tax return. The income reported on the 1099-MISC form is subject to self-employment tax, which is a tax on net earnings from self-employment. You must also pay federal income tax on the income reported on the 1099-MISC form.

1099-NEC Form

Starting from the tax year 2020, the 1099-NEC form is used to report non-employee compensation. This means that instead of using the 1099-MISC form to report non-employee compensation, businesses must use the 1099-NEC form. The 1099-NEC form is used to report compensation paid to independent contractors and freelancers. This includes payments made for services such as consulting, software development, and graphic design.

The 1099-NEC form must be provided to independent contractors and filed with the IRS by January 31st. The form is used to report the total amount of non-employee compensation paid during the tax year. The independent contractor is responsible for reporting the income on their tax return and paying any taxes owed.

The 1099-NEC form must be provided to independent contractors and filed with the IRS by January 31st. The form is used to report the total amount of non-employee compensation paid during the tax year. The independent contractor is responsible for reporting the income on their tax return and paying any taxes owed.

1099-R Form

The 1099-R form is used to report distributions from retirement plans such as pensions, annuities, and IRA’s. This form is used to report distributions made to the account owner and any taxes that were withheld. It is also used to report distributions made to beneficiaries of the account owner.

If you receive a 1099-R form, you must report the distribution on your tax return. The amount of the distribution that is subject to federal income tax varies depending on the type of account and the age of the account owner.

If you receive a 1099-R form, you must report the distribution on your tax return. The amount of the distribution that is subject to federal income tax varies depending on the type of account and the age of the account owner.

1099-INT Form

The 1099-INT form is used to report interest income paid to individuals. This form is used by banks, brokerage firms, and other institutions to report the amount of interest paid on bank accounts, bonds, and other investments to the IRS and the account holder. The account holder is responsible for reporting the interest income on their tax return.

The amount of interest income reported on the 1099-INT form is subject to federal income tax. If you receive a 1099-INT form, you must report the interest income on your tax return and pay any taxes owed.

The amount of interest income reported on the 1099-INT form is subject to federal income tax. If you receive a 1099-INT form, you must report the interest income on your tax return and pay any taxes owed.

1099-DIV Form

The 1099-DIV form is used to report dividends and other distributions paid by corporations to shareholders. This form is used by brokerage firms and other institutions to report the dividends and distributions paid to the IRS and the shareholder. The shareholder is responsible for reporting the income on their tax return.

The amount of dividends and distributions reported on the 1099-DIV form is subject to federal income tax. If you receive a 1099-DIV form, you must report the income on your tax return and pay any taxes owed.

The amount of dividends and distributions reported on the 1099-DIV form is subject to federal income tax. If you receive a 1099-DIV form, you must report the income on your tax return and pay any taxes owed.

Conclusion

In conclusion, 1099 forms are important documents used by the IRS to report payments made to non-employees. There are several types of 1099 forms, each used to report different types of payments. If you receive a 1099 form, you must report the income on your tax return and pay any taxes owed. As a business owner, it is important to understand which types of payments require a 1099 form and to file the forms on time to avoid penalties and fines.