When it comes to tax season, there are a few key documents that individuals and businesses need to be familiar with in order to properly file their taxes. One of these documents is the 1099-NEC form.

What is the 1099-NEC Form?

The 1099-NEC form is a tax document that is used to report non-employee compensation. This includes payments made to independent contractors, freelancers, and other self-employed individuals. Prior to tax year 2020, non-employee compensation was reported on the 1099-MISC form. However, with the introduction of the 1099-NEC form, non-employee compensation must now be reported on this form instead.

It is important to note that the 1099-NEC form is only used to report non-employee compensation. Other types of income, such as rental income or investment income, are reported on different forms.

It is important to note that the 1099-NEC form is only used to report non-employee compensation. Other types of income, such as rental income or investment income, are reported on different forms.

Why was the 1099-NEC Form Introduced?

The introduction of the 1099-NEC form was intended to simplify tax reporting for businesses and individuals. By separating non-employee compensation from other types of income, it is now easier for taxpayers to distinguish between different types of income and to file their taxes accurately.

In addition to simplifying tax reporting, the introduction of the 1099-NEC form also helps to prevent fraud. In the past, some taxpayers would report non-employee compensation on the 1099-MISC form even if it was not actually non-employee compensation. By requiring non-employee compensation to be reported on a separate form, it is now more difficult to improperly report this type of income.

In addition to simplifying tax reporting, the introduction of the 1099-NEC form also helps to prevent fraud. In the past, some taxpayers would report non-employee compensation on the 1099-MISC form even if it was not actually non-employee compensation. By requiring non-employee compensation to be reported on a separate form, it is now more difficult to improperly report this type of income.

When is the 1099-NEC Form Required?

The 1099-NEC form is required to be filed by businesses and individuals who make payments of $600 or more to non-employee service providers during a tax year. The form must be filed with the IRS by January 31st of the year following the tax year. In addition, a copy of the form must be provided to the service provider no later than January 31st as well.

If a business or individual fails to file the 1099-NEC form or provides incorrect information on the form, they may be subject to penalties and fines from the IRS. It is important to ensure that all information on the form is accurate and that the form is filed on time in order to avoid any penalties.

If a business or individual fails to file the 1099-NEC form or provides incorrect information on the form, they may be subject to penalties and fines from the IRS. It is important to ensure that all information on the form is accurate and that the form is filed on time in order to avoid any penalties.

How to Fill out the 1099-NEC Form

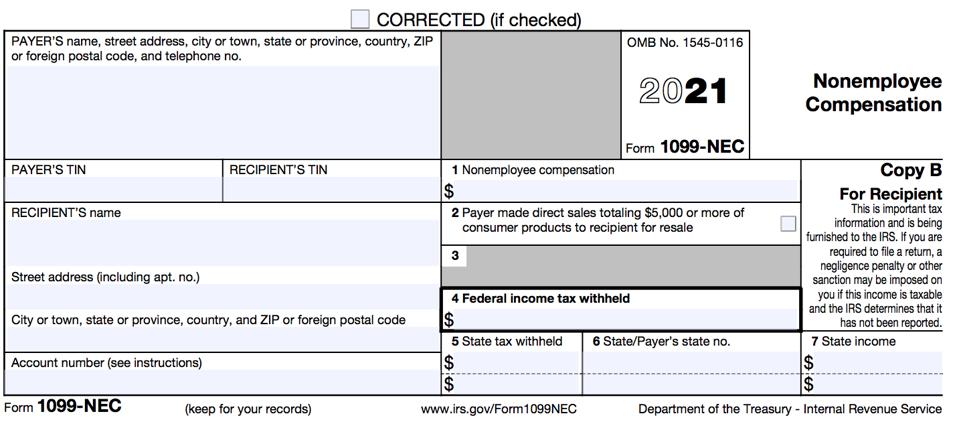

Filling out the 1099-NEC form is relatively straightforward. The form requires basic information about the service provider, including their name, address, and taxpayer identification number (TIN). In addition, the form requires information about the amount of non-employee compensation that was paid during the tax year.

It is important to ensure that all information on the form is accurate and that the correct amounts are reported. Any errors or omissions on the form can result in penalties and fines from the IRS.

It is important to ensure that all information on the form is accurate and that the correct amounts are reported. Any errors or omissions on the form can result in penalties and fines from the IRS.

1099-NEC Form vs. 1099-MISC Form

As previously mentioned, prior to tax year 2020, non-employee compensation was reported on the 1099-MISC form. While the 1099-MISC form is still in use for other types of income, the 1099-NEC form is now required to be used for reporting non-employee compensation.

It is important for businesses and individuals to be aware of the differences between the two forms and to ensure that they are filing the correct form for each type of income that they are reporting. Filing the wrong form can result in penalties and fines from the IRS.

Conclusion

The 1099-NEC form is an important tax document for businesses and individuals who make payments to non-employee service providers. By properly filling out and filing this form, taxpayers can accurately report their non-employee compensation and avoid penalties and fines from the IRS. It is important to stay up-to-date on any changes to tax reporting requirements in order to ensure compliance with IRS regulations.

At the end of the day, the 1099-NEC form is just one of many tax forms that businesses and individuals need to be familiar with. By taking the time to understand these forms and their requirements, taxpayers can ensure that they are filing their taxes accurately and avoiding any penalties or fines.

At the end of the day, the 1099-NEC form is just one of many tax forms that businesses and individuals need to be familiar with. By taking the time to understand these forms and their requirements, taxpayers can ensure that they are filing their taxes accurately and avoiding any penalties or fines.

Additional Resources

These resources can provide additional information and guidance on how to properly fill out and file the 1099-NEC form, as well as other tax forms that may be required during tax season.

These resources can provide additional information and guidance on how to properly fill out and file the 1099-NEC form, as well as other tax forms that may be required during tax season.

Where to Get Help

If you need assistance with tax planning or preparation, it may be helpful to consult with a tax professional. A tax professional can provide guidance on how to properly report your income and deductions and can help you avoid any potential issues with the IRS.

Additionally, there are many online resources available that can help you understand tax requirements and prepare your tax documents. These resources can provide tips and guidance on how to navigate the complexities of tax season and ensure that you are filing your taxes accurately and on time.

Additionally, there are many online resources available that can help you understand tax requirements and prepare your tax documents. These resources can provide tips and guidance on how to navigate the complexities of tax season and ensure that you are filing your taxes accurately and on time.

Overall, while tax season can be stressful and overwhelming, it is important to take the time to properly prepare and file your tax documents. By staying informed and seeking help when needed, you can ensure that you are following IRS regulations and avoiding any potential penalties or fines.