Good day everyone. Today, we are going to talk about the IRS Form 1099. If you are not familiar with it, don’t worry, we will explain everything you need to know. The IRS Form 1099 is a very important document that is used to report various types of income other than wages, salaries, and tips. This can include income from freelance work, investment returns, and more.

1099 Forms 2021 Printable | Calendar Template Printable

If you are self-employed or have received other types of income from sources other than your employer, you may need to file a Form 1099. This form is used to report income that is not subject to withholdings, and it is an important part of the tax process for those who fall into this category.

If you are self-employed or have received other types of income from sources other than your employer, you may need to file a Form 1099. This form is used to report income that is not subject to withholdings, and it is an important part of the tax process for those who fall into this category.

What To Do With A 1099 from Coinbase or Another Exchange | TokenTax

If you have received a 1099 from Coinbase or another exchange, you will need to report this income on your taxes. Even if you do not receive a 1099, you are still responsible for reporting all income on your tax return.

If you have received a 1099 from Coinbase or another exchange, you will need to report this income on your taxes. Even if you do not receive a 1099, you are still responsible for reporting all income on your tax return.

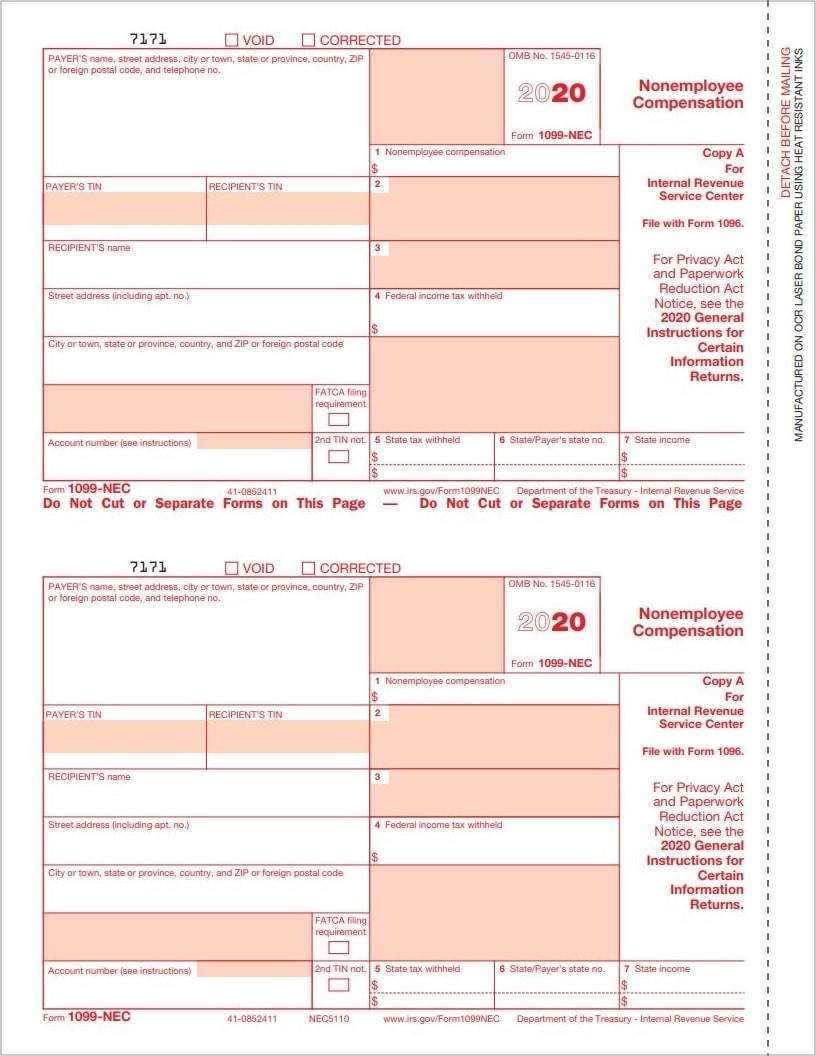

1099-NEC Form 2021

The IRS has updated the Form 1099 for the 2021 tax year, and they have introduced a new version of the form called the 1099-NEC. This form replaces the 1099-MISC for reporting nonemployee compensation, and it is important to understand the differences between the two.

The IRS has updated the Form 1099 for the 2021 tax year, and they have introduced a new version of the form called the 1099-NEC. This form replaces the 1099-MISC for reporting nonemployee compensation, and it is important to understand the differences between the two.

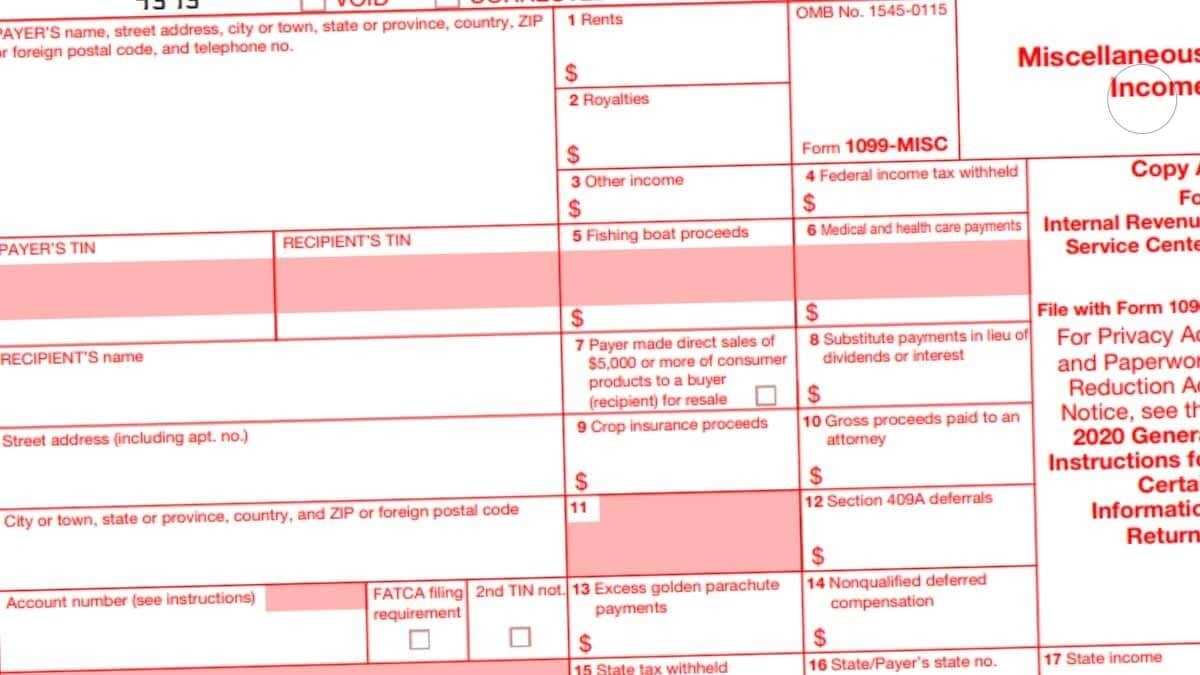

1099 Misc Template - klauuuudia

If you are filing a 1099-MISC, you will need to use a template to ensure that your form is complete and accurate. Some common templates include those for rent, royalties, and other miscellaneous income.

Form 1099 Definition

:max_bytes(150000):strip_icc()/1099r-eda9fdcb4d82449da27f9f30a318aaa3.jpg) The Form 1099 is used to report various types of income other than wages, salaries, and tips. This can include income from freelance work, investment returns, and more. It is important to understand the definition of this form, as it will impact how you file your taxes and report your income.

The Form 1099 is used to report various types of income other than wages, salaries, and tips. This can include income from freelance work, investment returns, and more. It is important to understand the definition of this form, as it will impact how you file your taxes and report your income.

W9 Vs 1099: A Simple Guide To Contractor Tax Forms | Bench throughout

The W-9 and 1099 forms are both used when working with contractors, but they serve different purposes. The W-9 is used to collect information from the contractor, while the 1099 is used to report payments made to the contractor. Knowing the differences between these two forms is important when working with freelancers or contractors.

The W-9 and 1099 forms are both used when working with contractors, but they serve different purposes. The W-9 is used to collect information from the contractor, while the 1099 is used to report payments made to the contractor. Knowing the differences between these two forms is important when working with freelancers or contractors.

1099 Forms 2021 Printable | Calendar Template Printable

As we mentioned earlier, if you are self-employed or have received other types of income from sources other than your employer, you may need to file a Form 1099. This form is used to report income that is not subject to withholdings, and it is an important part of the tax process for those who fall into this category.

As we mentioned earlier, if you are self-employed or have received other types of income from sources other than your employer, you may need to file a Form 1099. This form is used to report income that is not subject to withholdings, and it is an important part of the tax process for those who fall into this category.

1099 Form 2020 📝 Get IRS Form 1099 Printable Blank PDF: Online Tax Form

If you need to file a Form 1099 for the 2020 tax year, you can find printable blank PDFs online. This can make the process of filling out the form much easier, and it can help ensure that you are completing the form correctly.

If you need to file a Form 1099 for the 2020 tax year, you can find printable blank PDFs online. This can make the process of filling out the form much easier, and it can help ensure that you are completing the form correctly.

For the Love of 1099s! Preparing for JD Edwards Year-End – Circular

Preparing for the end of the year can be a stressful time for businesses, and this is especially true when it comes to preparing and filing the necessary tax forms. If you are using JD Edwards, there are some steps you can take to make sure that you are ready for year-end and that your 1099s are filed correctly.

Preparing for the end of the year can be a stressful time for businesses, and this is especially true when it comes to preparing and filing the necessary tax forms. If you are using JD Edwards, there are some steps you can take to make sure that you are ready for year-end and that your 1099s are filed correctly.

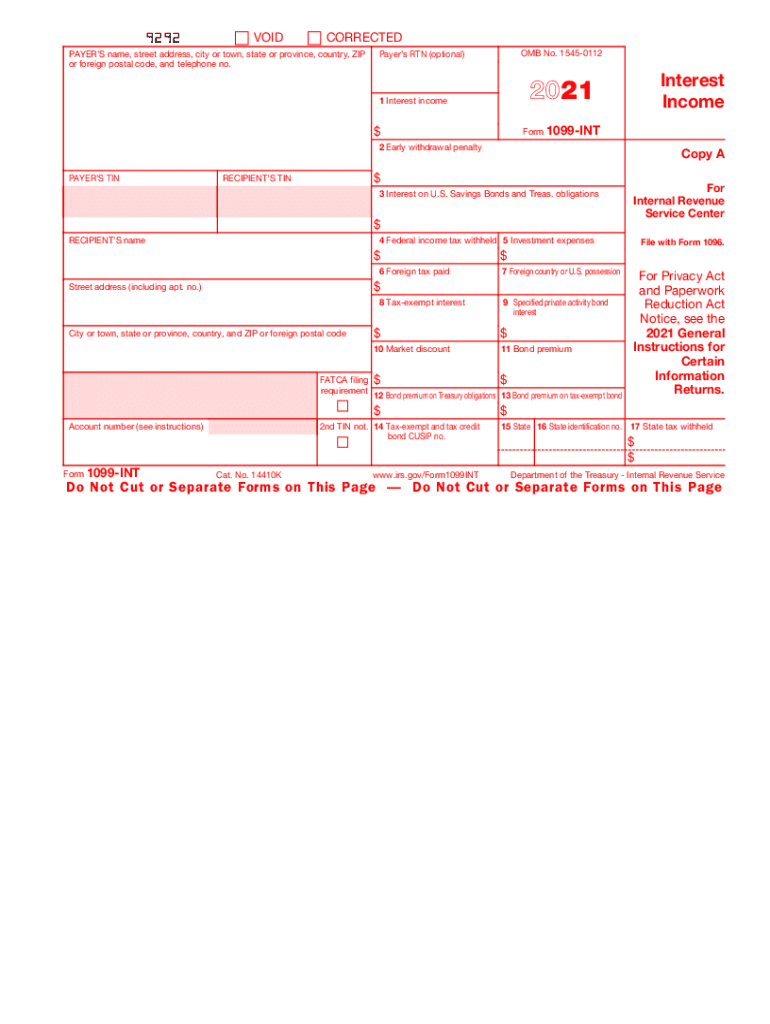

2021 Form IRS 1099-INT Fill Online, Printable, Fillable, Blank - pdfFiller

The 1099-INT form is used to report interest earned on investments, and it is an important part of the tax process for those who have earned interest throughout the year. If you need to fill out this form and would like to do it online, you can find fillable and printable options at pdfFiller.

The 1099-INT form is used to report interest earned on investments, and it is an important part of the tax process for those who have earned interest throughout the year. If you need to fill out this form and would like to do it online, you can find fillable and printable options at pdfFiller.

We hope that this information has been helpful in understanding the importance of the IRS Form 1099. Remember, it is important to report all income on your taxes, and filing a 1099 is a key part of this process. If you have any questions about filing your taxes or need further assistance, be sure to consult with a tax professional.