Have you heard about the new IRS Form 1099-NEC? If you’re a self-employed individual or a small business owner, this is something you should definitely familiarize yourself with. The 1099-NEC Form was created for reporting non-employee compensation and it replaces the use of Box 7 on the traditional 1099-MISC form.

What is the 1099-NEC Form?

The 1099-NEC Form is a new tax form that is used to report non-employee compensation. Non-employee compensation is any money that is paid to an individual who is not an employee of the business, such as independent contractors and freelancers. Previously, non-employee compensation was reported on Box 7 of the 1099-MISC form. However, starting with the 2020 tax year, non-employee compensation is now reported on the 1099-NEC Form instead.

The 1099-NEC Form is a new tax form that is used to report non-employee compensation. Non-employee compensation is any money that is paid to an individual who is not an employee of the business, such as independent contractors and freelancers. Previously, non-employee compensation was reported on Box 7 of the 1099-MISC form. However, starting with the 2020 tax year, non-employee compensation is now reported on the 1099-NEC Form instead.

Why was the 1099-NEC Form created?

The 1099-NEC Form was created to make it easier for businesses and self-employed individuals to report non-employee compensation. Previously, businesses had to use the 1099-MISC form to report both non-employee compensation and other types of payments, such as rent and royalties. This often caused confusion and errors, as businesses would sometimes report non-employee compensation on the wrong line of the 1099-MISC form.

The 1099-NEC Form was created to make it easier for businesses and self-employed individuals to report non-employee compensation. Previously, businesses had to use the 1099-MISC form to report both non-employee compensation and other types of payments, such as rent and royalties. This often caused confusion and errors, as businesses would sometimes report non-employee compensation on the wrong line of the 1099-MISC form.

With the introduction of the 1099-NEC Form, businesses can now report non-employee compensation separately, which helps to reduce confusion and errors. This new form is also more straightforward and easier to fill out than the 1099-MISC form, which has multiple boxes and sections.

Who needs to file a 1099-NEC Form?

If you’re a business or self-employed individual who has paid more than $600 in non-employee compensation to a single individual or business, you will need to file a 1099-NEC Form for that individual or business. This includes payments made to independent contractors, freelancers, and other non-employees.

If you’re a business or self-employed individual who has paid more than $600 in non-employee compensation to a single individual or business, you will need to file a 1099-NEC Form for that individual or business. This includes payments made to independent contractors, freelancers, and other non-employees.

It’s important to note that if you only paid a non-employee less than $600 during the tax year, you do not need to file a 1099-NEC Form for that individual or business.

How do you fill out a 1099-NEC Form?

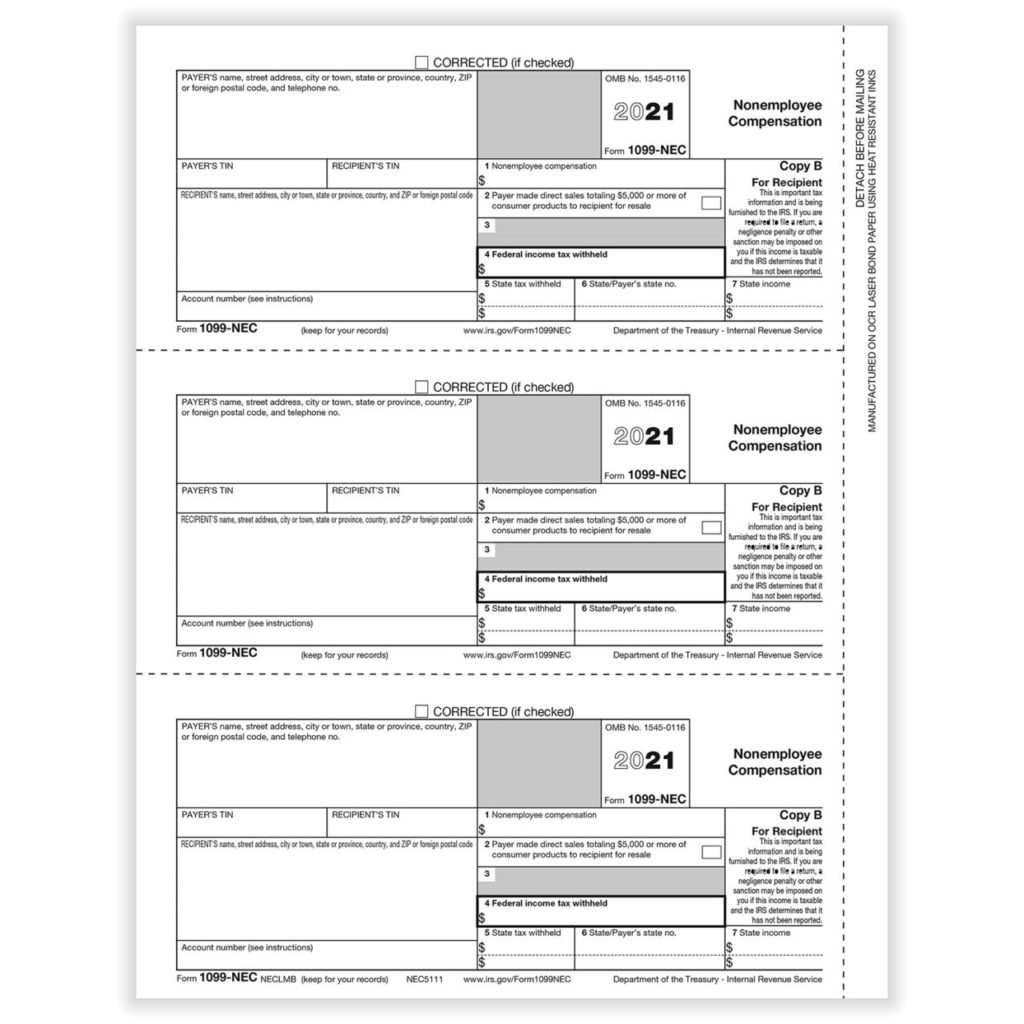

Here’s a step-by-step guide on how to fill out a 1099-NEC Form:

Here’s a step-by-step guide on how to fill out a 1099-NEC Form:

- Enter your name and contact information in the “Payer” section of the form.

- Enter the recipient’s name and contact information in the “Recipient” section of the form.

- Enter the amount of non-employee compensation that you paid to the recipient in Box 1 of the form.

- If you withheld any federal income tax from the payment, enter that amount in Box 4 of the form.

- If you paid any state income tax, enter the amount in Box 5 of the form.

- Finally, file Copy A of the form with the IRS by February 28th of the year following the tax year. You will also need to provide a copy to the recipient by January 31st of the year following the tax year.

What are the deadlines for filing the 1099-NEC Form?

If you are filing a 1099-NEC Form for the 2020 tax year, the deadline for filing and distributing the form was February 1st, 2021. However, if you missed this deadline, it’s still important to file the form as soon as possible to avoid any penalties from the IRS.

If you are filing a 1099-NEC Form for the 2020 tax year, the deadline for filing and distributing the form was February 1st, 2021. However, if you missed this deadline, it’s still important to file the form as soon as possible to avoid any penalties from the IRS.

For future tax years, the deadline for filing Copy A of the 1099-NEC Form with the IRS is January 31st of the year following the tax year. You will also need to provide a copy to the recipient by this same deadline.

What happens if you don’t file a 1099-NEC Form?

If you are required to file a 1099-NEC Form but fail to do so, you can face penalties from the IRS. The penalty for not filing a 1099-NEC Form with the IRS is $50 per form if you file within 30 days of the due date, with a maximum penalty of $187,500 per year. If you file the form more than 30 days after the due date but before August 1st, the penalty is $110 per form, with a maximum penalty of $536,000 per year. If you file the form after August 1st or if you do not file it at all, the penalty is $280 per form, with a maximum penalty of $1,072,500 per year.

If you are required to file a 1099-NEC Form but fail to do so, you can face penalties from the IRS. The penalty for not filing a 1099-NEC Form with the IRS is $50 per form if you file within 30 days of the due date, with a maximum penalty of $187,500 per year. If you file the form more than 30 days after the due date but before August 1st, the penalty is $110 per form, with a maximum penalty of $536,000 per year. If you file the form after August 1st or if you do not file it at all, the penalty is $280 per form, with a maximum penalty of $1,072,500 per year.

Additionally, if you intentionally disregard the 1099-NEC filing requirements, you can face a penalty of at least $550 per form.

Final Thoughts

The new 1099-NEC Form should simplify the process of reporting non-employee compensation for businesses and individuals. By using this form, you can avoid confusion and errors that can arise from using the 1099-MISC form.

The new 1099-NEC Form should simplify the process of reporting non-employee compensation for businesses and individuals. By using this form, you can avoid confusion and errors that can arise from using the 1099-MISC form.

If you are a business or self-employed individual who pays non-employee compensation, it’s important to familiarize yourself with the 1099-NEC Form and to make sure that you file it on time and correctly. This will help you avoid penalties from the IRS and will ensure that your tax reporting is accurate.