Are you struggling to get your IRS Federal Taxes filed on time? The good news is that you can apply for an extension by completing Form 4868. This form grants you an automatic six-month extension to file your tax return.

How to Fill Out Form 4868

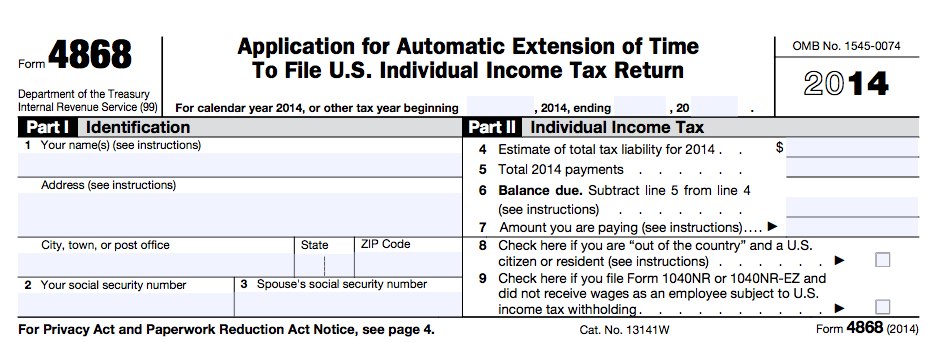

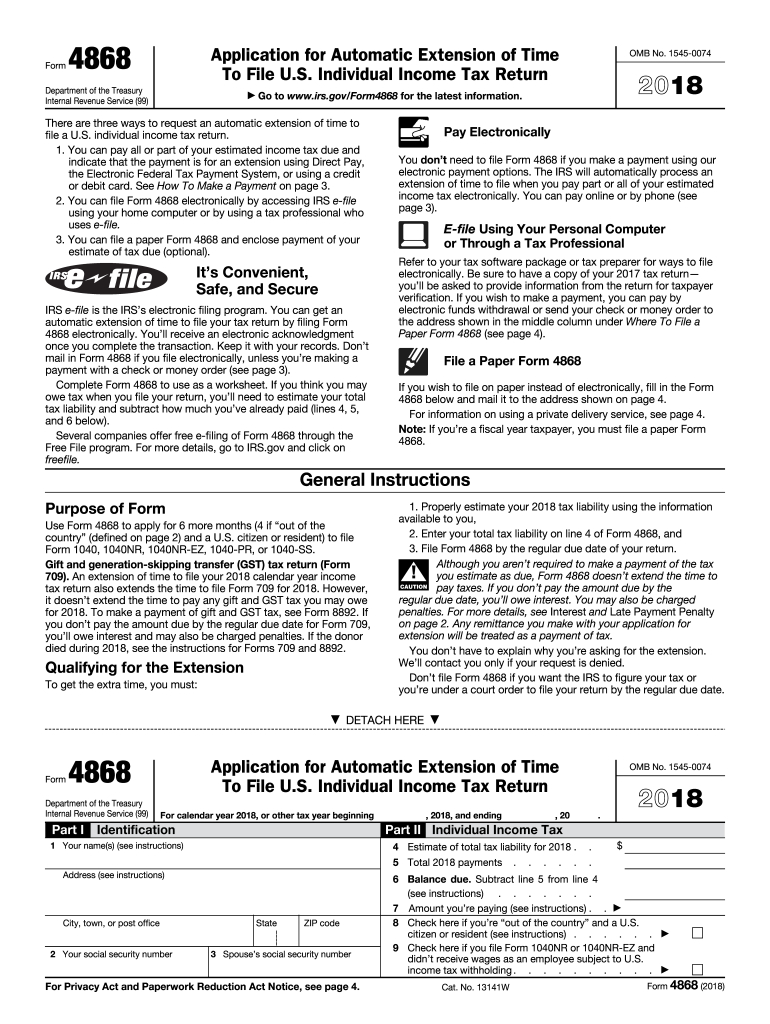

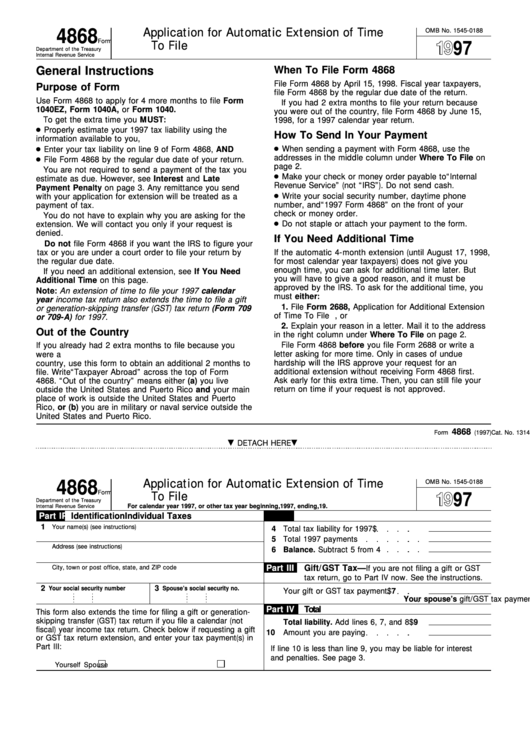

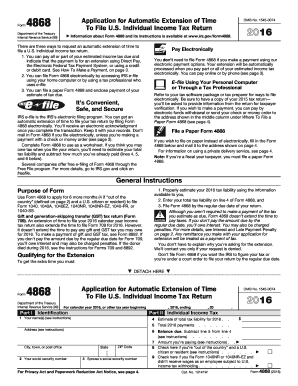

To fill out Form 4868, start by providing your personal information in the first section. This includes your full name and social security number. You will also need to provide your spouse’s full name and social security number if you are filing jointly.

To fill out Form 4868, start by providing your personal information in the first section. This includes your full name and social security number. You will also need to provide your spouse’s full name and social security number if you are filing jointly.

Next, you must provide an estimate of your total tax liability for the year. This includes any income tax, self-employment tax, and household employment tax you may owe. If you are unsure of the amount, you can use the worksheet provided in the form instructions to help you calculate it.

The next section of the form requires you to provide any payments you have already made towards your tax liability. This includes any federal income tax withheld from your pay, estimated tax payments, and any payments made with a prior tax return.

The Benefits of Filing an Extension

There are many benefits to filing an extension, including avoiding penalties for late filing and late payment. If you do not file your tax return by the due date (usually April 15th), you will be subject to a penalty of 5% of the unpaid tax liability for each month or partial month the tax return is late. This penalty can be as high as 25% of the unpaid tax liability. By filing an extension, you can avoid this penalty.

There are many benefits to filing an extension, including avoiding penalties for late filing and late payment. If you do not file your tax return by the due date (usually April 15th), you will be subject to a penalty of 5% of the unpaid tax liability for each month or partial month the tax return is late. This penalty can be as high as 25% of the unpaid tax liability. By filing an extension, you can avoid this penalty.

If you do not pay at least 90% of your tax liability by the due date, you will also be subject to a penalty for late payment. This penalty is 0.5% of the unpaid tax liability for each month or partial month the tax is not paid, up to a maximum of 25% of the unpaid tax liability. However, if you file an extension and pay at least 90% of your tax liability by the due date, you can avoid this penalty as well.

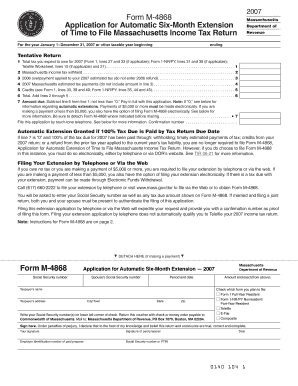

Forms and Templates to Help You File an Extension

If you are looking for additional resources to help you file your extension, there are several printable Form 4868 templates available online. These templates can help you fill out the form accurately and efficiently, ensuring that you do not miss any important information.

If you are looking for additional resources to help you file your extension, there are several printable Form 4868 templates available online. These templates can help you fill out the form accurately and efficiently, ensuring that you do not miss any important information.

There are also many other printable IRS Form 4868 templates available online. These templates may include additional worksheets and instructions to help you estimate your tax liability, calculate your payments, and file your extension form.

There are also many other printable IRS Form 4868 templates available online. These templates may include additional worksheets and instructions to help you estimate your tax liability, calculate your payments, and file your extension form.

Automatically Extend Your Filing Deadline

If you are eligible, you can use Form 4868 to apply for an automatic six-month extension of time to file your tax return. This means that your tax return will now be due on October 15th instead of April 15th. However, it is important to note that while an extension grants you more time to file your tax return, it does not grant you more time to pay your tax liability.

If you are eligible, you can use Form 4868 to apply for an automatic six-month extension of time to file your tax return. This means that your tax return will now be due on October 15th instead of April 15th. However, it is important to note that while an extension grants you more time to file your tax return, it does not grant you more time to pay your tax liability.

Additional Resources for Filing an Extension

If you are still unsure about how to file an extension, there are several resources available to help you. The IRS website provides detailed instructions on how to complete Form 4868, as well as answers to frequently asked questions.

If you are still unsure about how to file an extension, there are several resources available to help you. The IRS website provides detailed instructions on how to complete Form 4868, as well as answers to frequently asked questions.

You can also seek the assistance of a tax professional, who can help you navigate the complex tax code and ensure that you are in compliance with all relevant laws and regulations. Many tax professionals offer extension filing services and can help you estimate your tax liability, file your extension, and prepare your tax return.

Conclusion

Filing an extension can provide you with valuable additional time to prepare and file your tax return, as well as reduce the risk of penalties for late filing and late payment. By filling out Form 4868 accurately and on time, you can avoid unnecessary stress and headaches, and ensure that you are in compliance with all relevant tax laws and regulations.

Filing an extension can provide you with valuable additional time to prepare and file your tax return, as well as reduce the risk of penalties for late filing and late payment. By filling out Form 4868 accurately and on time, you can avoid unnecessary stress and headaches, and ensure that you are in compliance with all relevant tax laws and regulations.

Whether you choose to file your extension on your own or seek the assistance of a tax professional, there are numerous resources available to help you navigate the complex process of filing an extension and preparing your tax return. By taking advantage of these resources, you can ensure that you stay compliant with the IRS and avoid any unnecessary penalties or fees.

So take the first step towards a successful tax season by filing your extension today. With the right resources and a little bit of effort, you can set yourself up for success and ensure that you achieve the best possible outcome.

So take the first step towards a successful tax season by filing your extension today. With the right resources and a little bit of effort, you can set yourself up for success and ensure that you achieve the best possible outcome.

Thank you for taking the time to read this article. We hope that you have found it informative and useful, and that it has helped you gain a better understanding of the process of filing an extension and preparing your tax return.

Thank you for taking the time to read this article. We hope that you have found it informative and useful, and that it has helped you gain a better understanding of the process of filing an extension and preparing your tax return.