Many people often wonder about the sales tax rates in different states. Here, we have compiled a list of printable sales tax charts for various states.

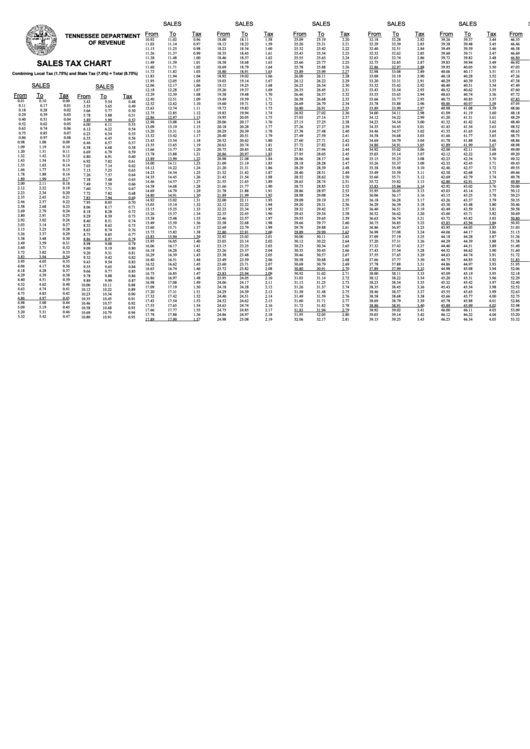

Tennessee Sales Tax Chart

The Tennessee Department of Revenue has provided a sales tax chart with a rate of 8.75%. This chart can be printed and used as a reference for sales tax in the state of Tennessee.

The Tennessee Department of Revenue has provided a sales tax chart with a rate of 8.75%. This chart can be printed and used as a reference for sales tax in the state of Tennessee.

Florida Sales Tax Table

Frompo has created a printable sales tax table for the state of Florida. This table can be used as a reference when calculating sales tax in Florida.

Frompo has created a printable sales tax table for the state of Florida. This table can be used as a reference when calculating sales tax in Florida.

Texas Sales Tax Chart

Google has a handy sales tax chart for those living in Texas. The chart shows the standard sales tax rate of 8.25%, and can be printed for convenience.

Google has a handy sales tax chart for those living in Texas. The chart shows the standard sales tax rate of 8.25%, and can be printed for convenience.

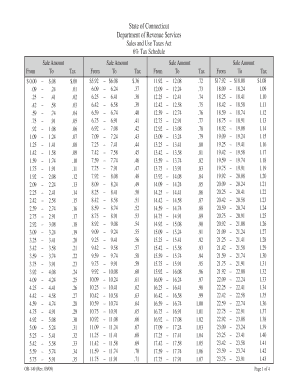

Connecticut Sales Tax Table

The state of Connecticut has a sales tax rate of 6.35%. This printable sales tax table can be used as a reference for those living in Connecticut.

The state of Connecticut has a sales tax rate of 6.35%. This printable sales tax table can be used as a reference for those living in Connecticut.

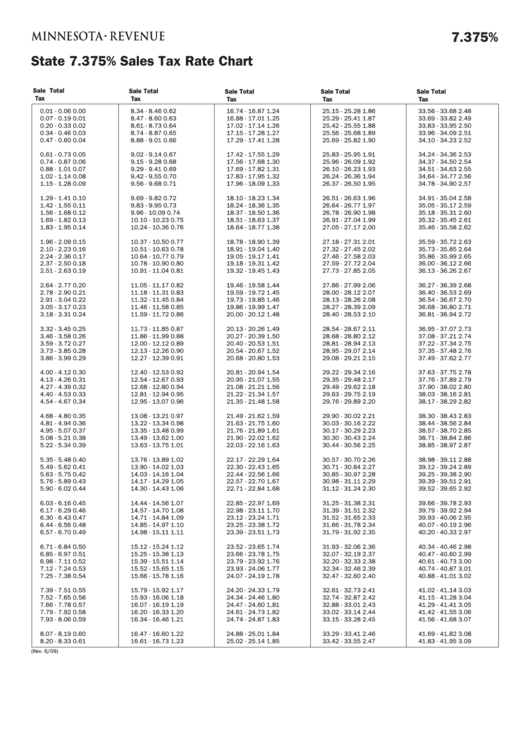

Minnesota Sales Tax Rate Chart

Minnesota also has a printable sales tax rate chart for those who need to reference it. The chart shows the current rate of 7.375%.

Minnesota also has a printable sales tax rate chart for those who need to reference it. The chart shows the current rate of 7.375%.

IRS Sales Tax Chart

The IRS has a comprehensive sales tax chart available for those who need to reference it for tax purposes. The chart shows the sales tax rates for all states and the District of Columbia.

The IRS has a comprehensive sales tax chart available for those who need to reference it for tax purposes. The chart shows the sales tax rates for all states and the District of Columbia.

State Sales Tax Table

The Tax Foundation has compiled a comprehensive sales tax table for all states and the District of Columbia. The table includes the state and local sales tax rates for each state.

The Tax Foundation has compiled a comprehensive sales tax table for all states and the District of Columbia. The table includes the state and local sales tax rates for each state.

Chemistry Chart

For those in need of a printable chemistry chart, this form from PDFfiller is a great resource. The chart includes elements’ atomic numbers, symbols, and atomic weights.

For those in need of a printable chemistry chart, this form from PDFfiller is a great resource. The chart includes elements’ atomic numbers, symbols, and atomic weights.

These sales tax charts and tables can be very helpful for those who need to reference the sales tax rates for various states. Whether you are a business owner or individual taxpayer, it is important to understand the sales tax rates in your state and how they affect your tax obligations.