Welcome to our comprehensive guide on W-4 forms for 2022! In this article, we’ll be covering everything you need to know about W-4 forms, including how to fill them out, what they’re for, and their importance in your tax filing process.

What is a W-4 Form?

A W-4 form is a tax document that is used to let your employer know how much tax they should withhold from your paycheck. It helps ensure that you’ll have the correct amount of taxes withheld throughout the year so that you won’t end up owing the IRS come tax time.

Most people will fill out a W-4 form when they start a new job, but you can also update your form at any time if your tax situation changes. Some common reasons for updating your W-4 form include getting married, having a child, or getting a new job.

Why is it important to fill out a W-4 Form?

One of the most important reasons to fill out a W-4 form is to make sure that you’re not under-withholding or over-withholding your taxes. If you’re under-withholding, you may end up owing the IRS money come tax time. If you’re over-withholding, then you’re essentially giving the government an interest-free loan with your money throughout the year.

Another important reason to fill out a W-4 form is to ensure that you’re taking advantage of any tax credits and deductions that you may be eligible for. By filling out your W-4 form correctly, you’re essentially putting yourself in the best position possible to maximize your tax savings and minimize your tax liability.

How to Fill Out a W-4 Form

Now that you know what a W-4 form is and why it’s important, let’s take a look at how to fill one out.

Step 1: Personal Information

The first section of the W-4 form asks for your personal information, including your name, address, and social security number. Make sure that you fill out this section as accurately as possible, as any errors could cause issues with your tax filing.

Step 2: Filing Status

The next section of the form asks for your filing status. There are several options to choose from, including:

- Single

- Married filing jointly

- Married filing separately

- Head of household

Make sure that you choose the correct filing status based on your personal situation.

Step 3: Dependents

The third section of the form asks you to list any dependents that you have. Dependents can include children, elderly parents, or other family members that you provide financial support for.

Listing your dependents can help you qualify for certain tax credits and deductions, so make sure that you include everyone that you’re legally responsible for.

Step 4: Additional Income

If you have any additional income aside from your regular paycheck, such as income from freelance work or investment earnings, you’ll need to report it in this section of the form.

By reporting your additional income, you’ll be able to calculate how much tax you’ll need to withhold from your main paycheck to ensure that you’re covering your tax liability for the additional income as well.

Step 5: Deductions and Adjustments

In this section, you’ll be able to claim any deductions or adjustments that you’re eligible for. Deductions are expenses that you’ve incurred that can be subtracted from your taxable income, while adjustments are deductions that are specifically related to your job or other financial situation.

Some common deductions and adjustments include:

- Mortgage interest

- Charitable donations

- Student loan interest

- Retirement contributions

Make sure that you claim all of the deductions and adjustments that you’re eligible for, as they can lower your taxable income and reduce your overall tax liability.

Step 6: Sign and Date

Finally, you’ll need to sign and date the form to certify that the information you’ve provided is accurate.

Conclusion

Now that you know how to fill out a W-4 form, you’re ready to take control of your tax situation and ensure that you’re maximizing your tax savings while minimizing your tax liability. By understanding the importance of W-4 forms and how they work, you can set yourself up for a successful tax filing season and avoid any issues with the IRS.

We hope that this guide has been helpful for you, and if you have any additional questions about W-4 forms or taxes in general, be sure to consult with a tax professional for personalized advice.

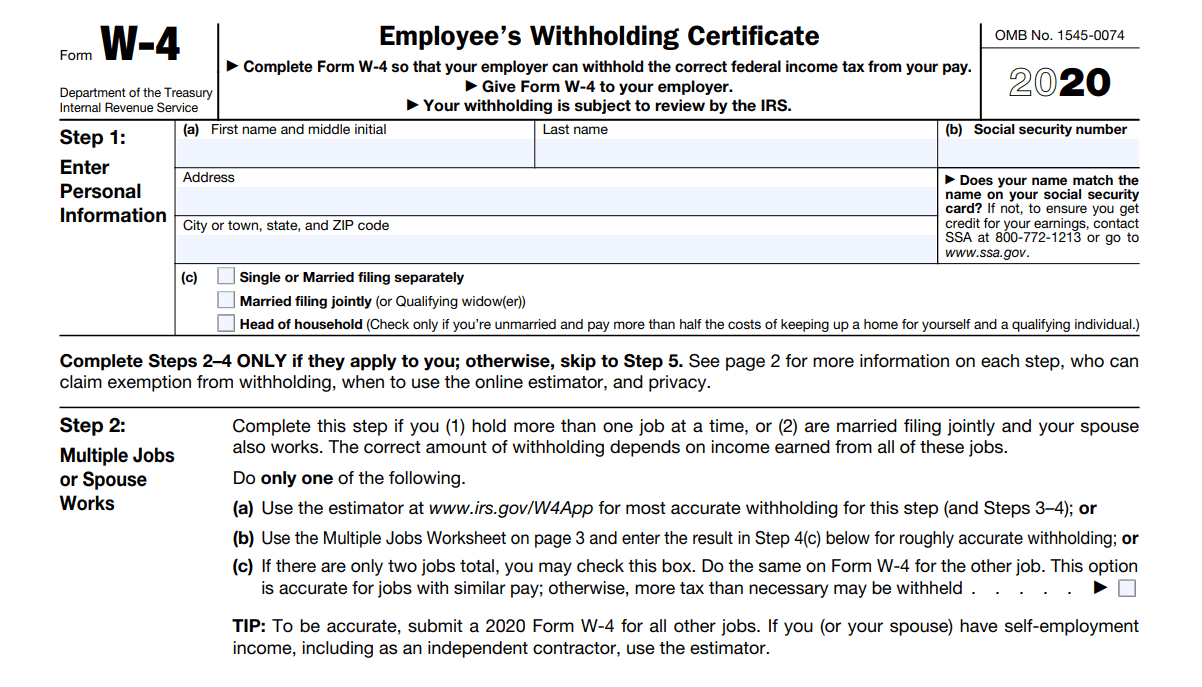

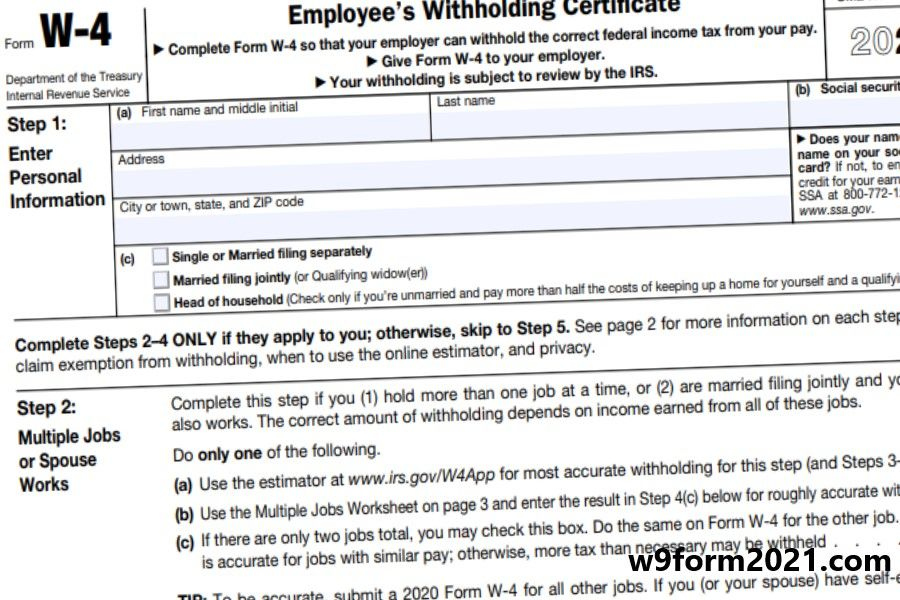

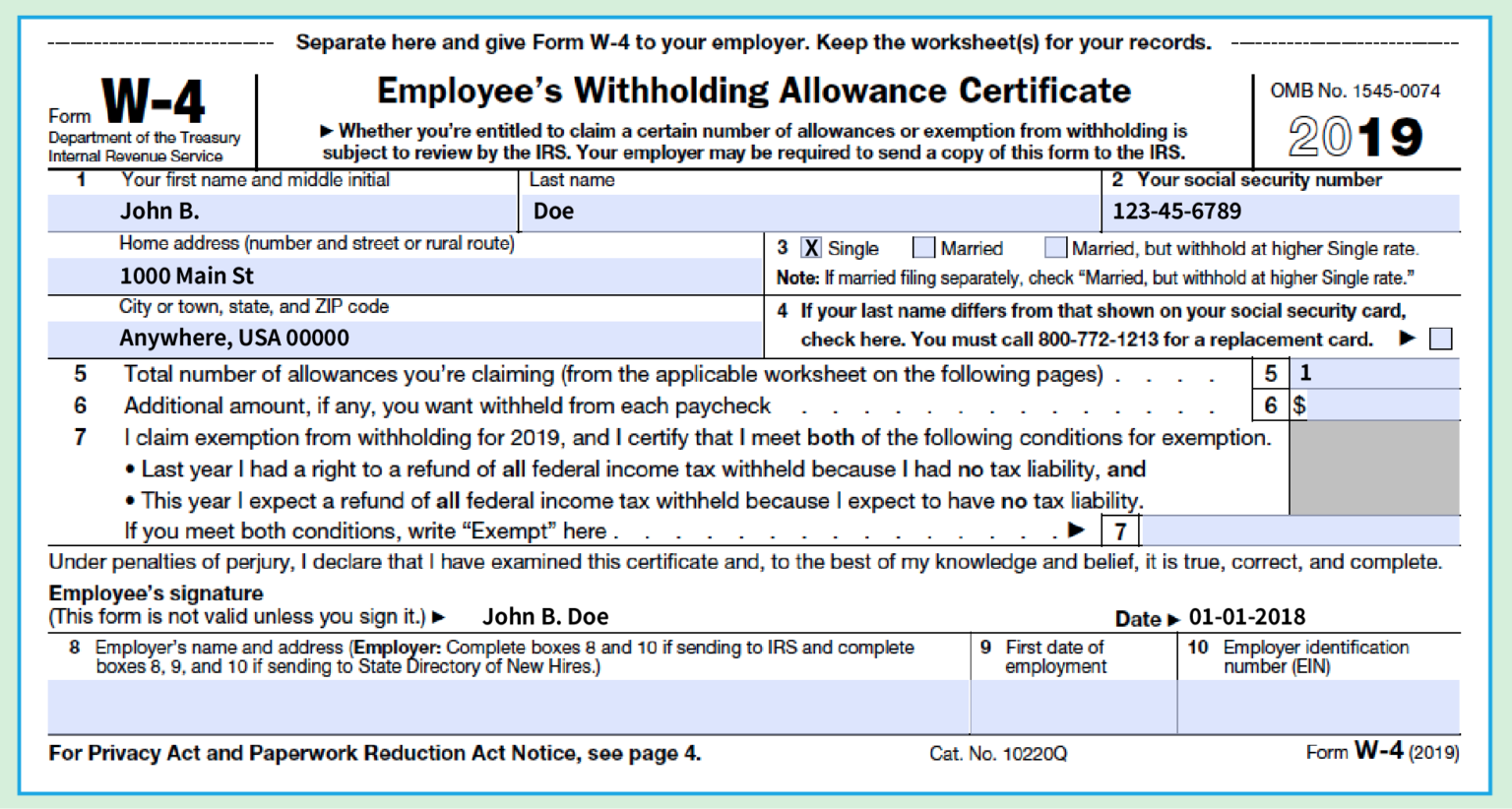

If you’re looking for a printable 2020 W4 form, the above image is a great option. Simply download and print the form, and follow the steps outlined in our guide to fill it out correctly.

If you’re looking for a printable 2020 W4 form, the above image is a great option. Simply download and print the form, and follow the steps outlined in our guide to fill it out correctly.

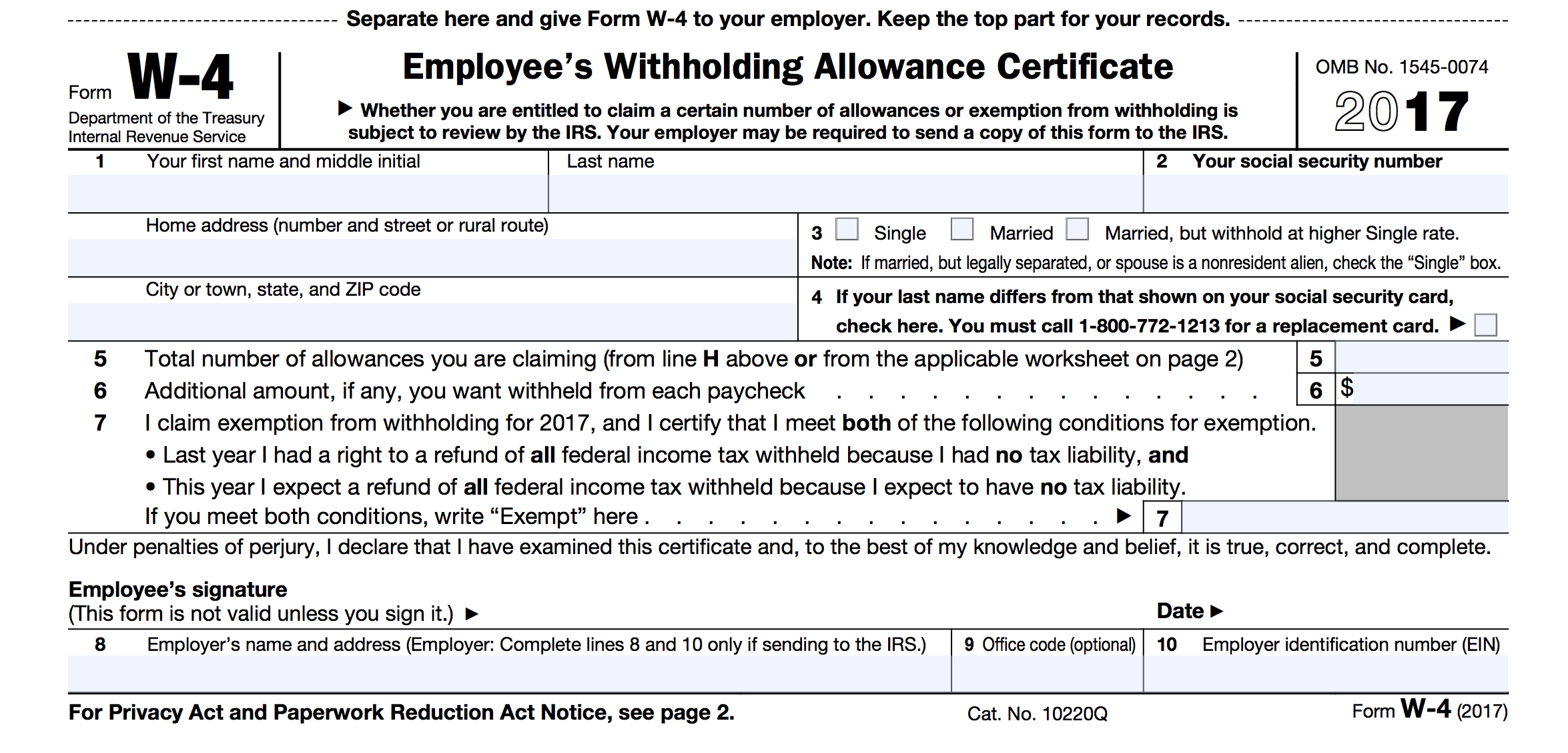

For those who need printable W4 and I9 forms, the above image provides a comprehensive overview of both forms. Be sure to follow the instructions carefully to ensure that you’re filling out each form correctly.

For those who need printable W4 and I9 forms, the above image provides a comprehensive overview of both forms. Be sure to follow the instructions carefully to ensure that you’re filling out each form correctly.

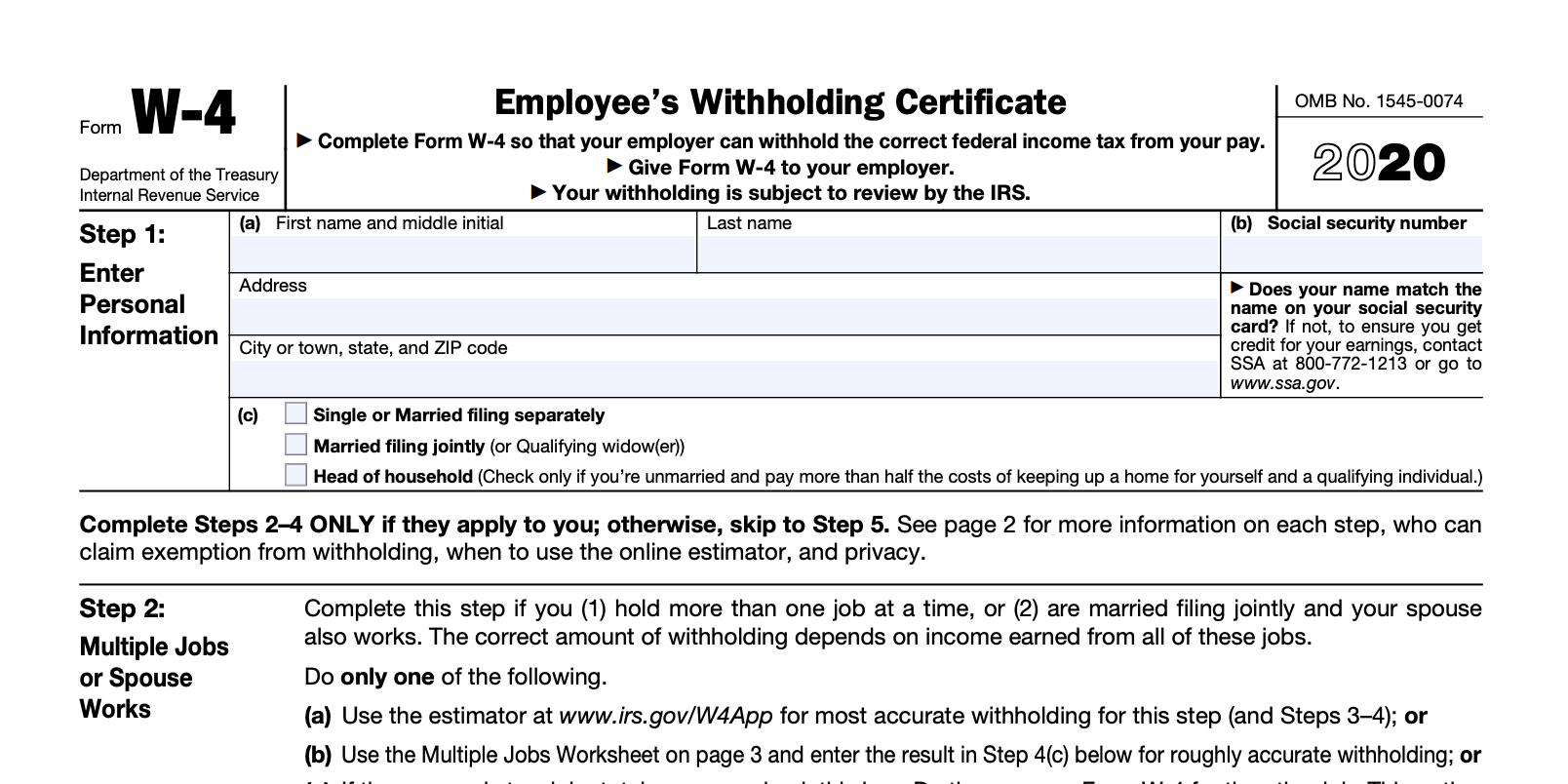

If you’re looking for free printable W-4 forms, the above image is a great resource. Make sure to double-check that you’re using the correct form for the current tax year before filling it out.

If you’re looking for free printable W-4 forms, the above image is a great resource. Make sure to double-check that you’re using the correct form for the current tax year before filling it out.

This image provides a helpful video tutorial on how to fill out your W4 tax form. Be sure to follow the instructions closely and ask questions if you’re unsure about any part of the process.

This image provides a helpful video tutorial on how to fill out your W4 tax form. Be sure to follow the instructions closely and ask questions if you’re unsure about any part of the process.

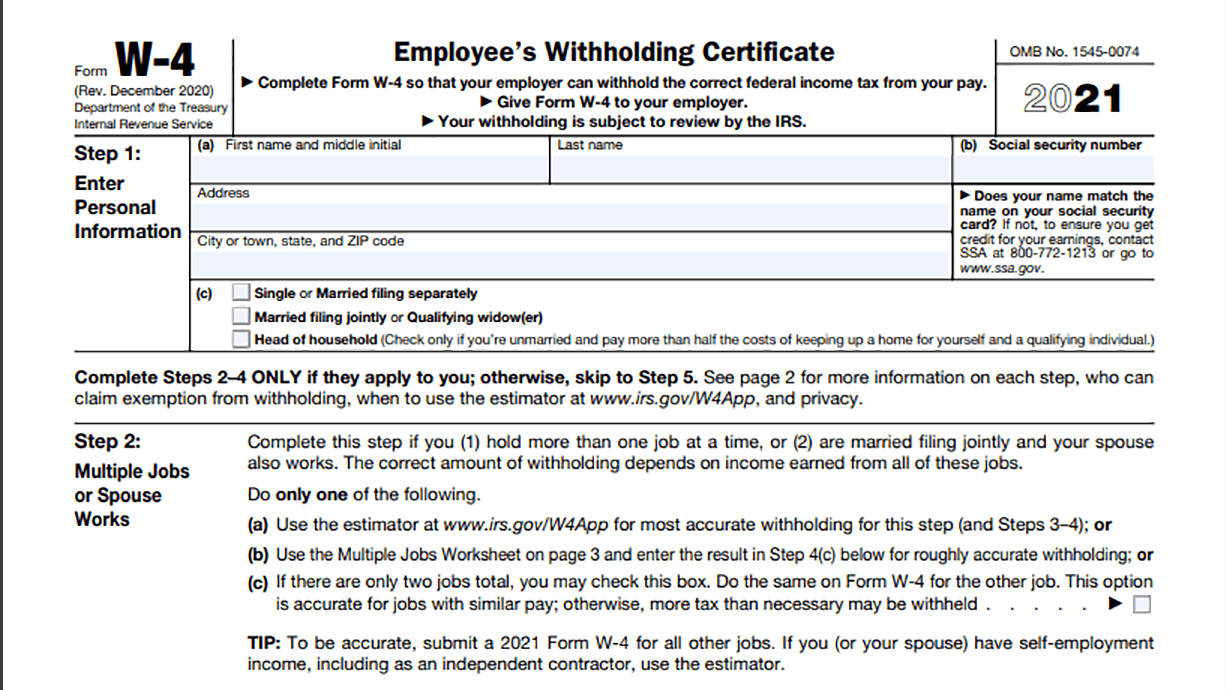

For those who need a W4 2021 form printable, the above image provides a great option. Make sure you double-check that you’re using the correct tax year form before filling it out.

For those who need a W4 2021 form printable, the above image provides a great option. Make sure you double-check that you’re using the correct tax year form before filling it out.

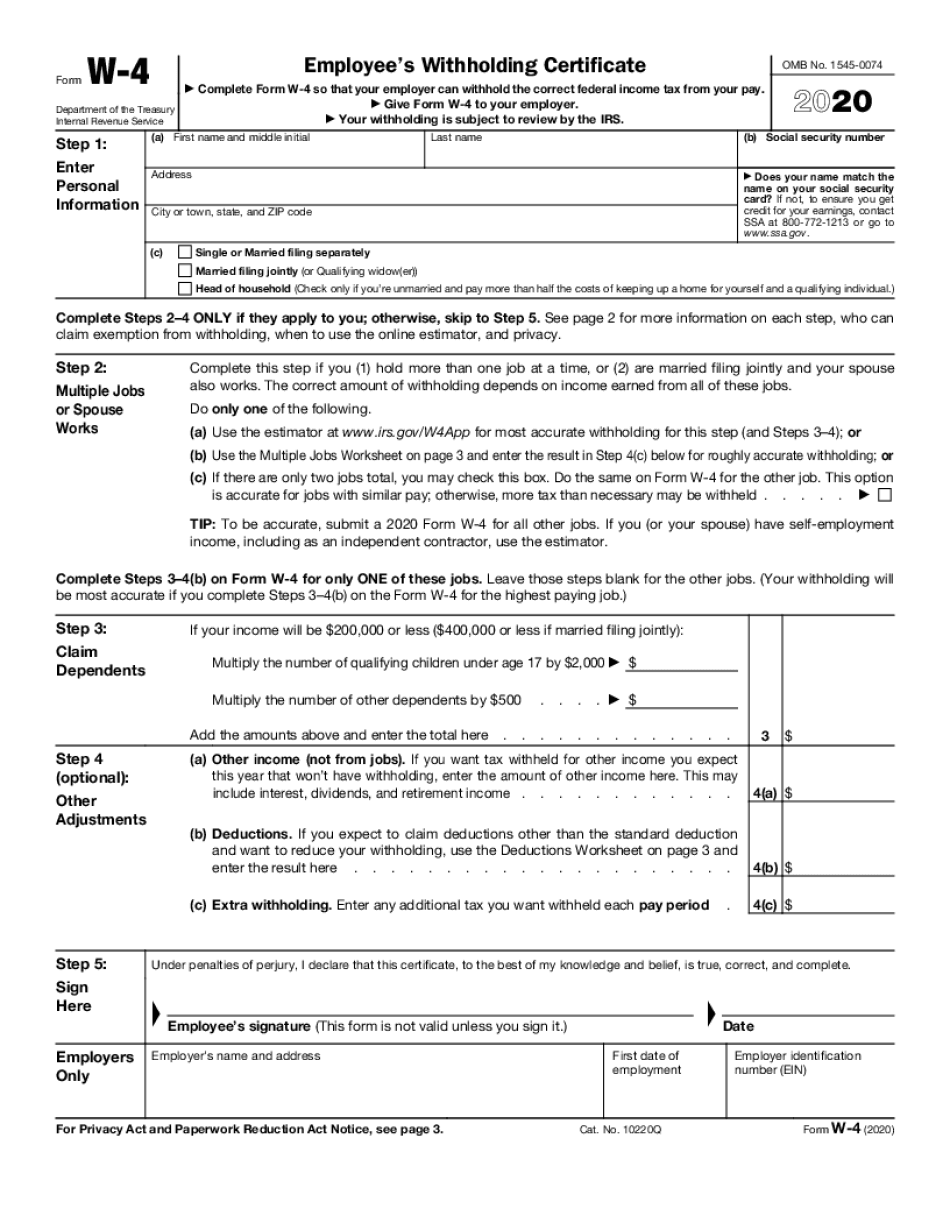

If you’re looking for a federal W4 worksheet 2020 that is printable and fillable online, the above image is a great option. Follow the instructions carefully to ensure that you’re filling out the form correctly.

If you’re looking for a federal W4 worksheet 2020 that is printable and fillable online, the above image is a great option. Follow the instructions carefully to ensure that you’re filling out the form correctly.

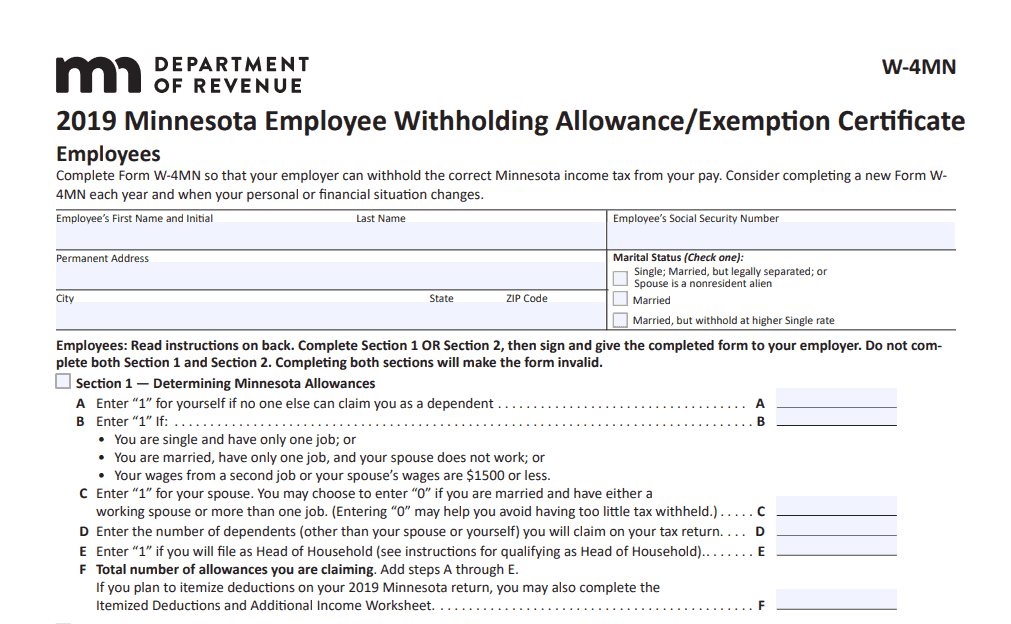

For those in Minnesota who need a W-4 2021 printable MN form, the above image provides a great resource. Be sure to follow the instructions closely to ensure that you’re filling out the form correctly.

For those in Minnesota who need a W-4 2021 printable MN form, the above image provides a great resource. Be sure to follow the instructions closely to ensure that you’re filling out the form correctly.

If you’re in need of W4 forms 2020 printable PDF files, the above image is a great option. Download and print the form, and follow the instructions outlined in our guide to fill it out correctly.

If you’re in need of W4 forms 2020 printable PDF files, the above image is a great option. Download and print the form, and follow the instructions outlined in our guide to fill it out correctly.

For those in California who need a CA W4 2021 form, the above image provides helpful information on the new W-4 form. Be sure to follow the instructions closely to ensure that you’re filling out the form correctly.

For those in California who need a CA W4 2021 form, the above image provides helpful information on the new W-4 form. Be sure to follow the instructions closely to ensure that you’re filling out the form correctly.

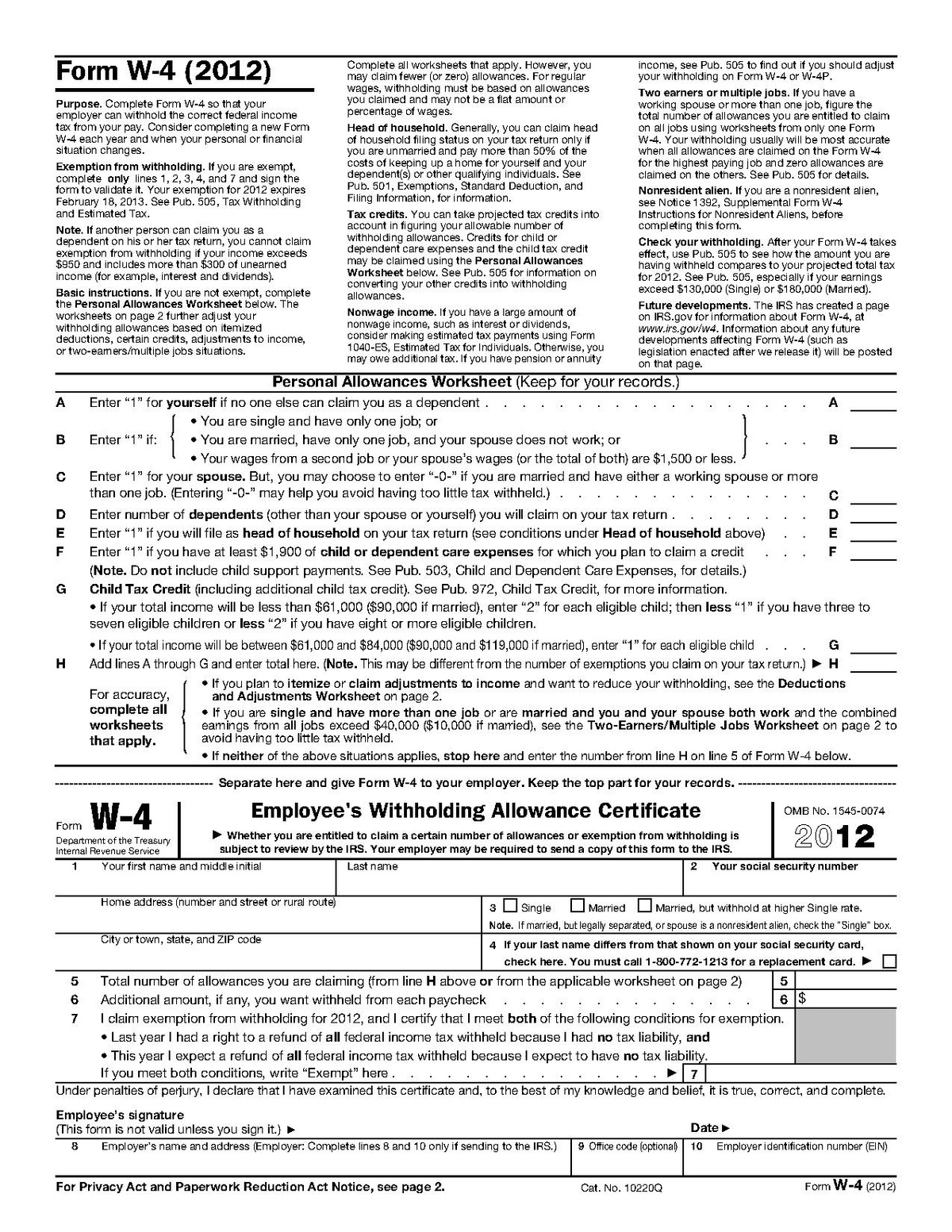

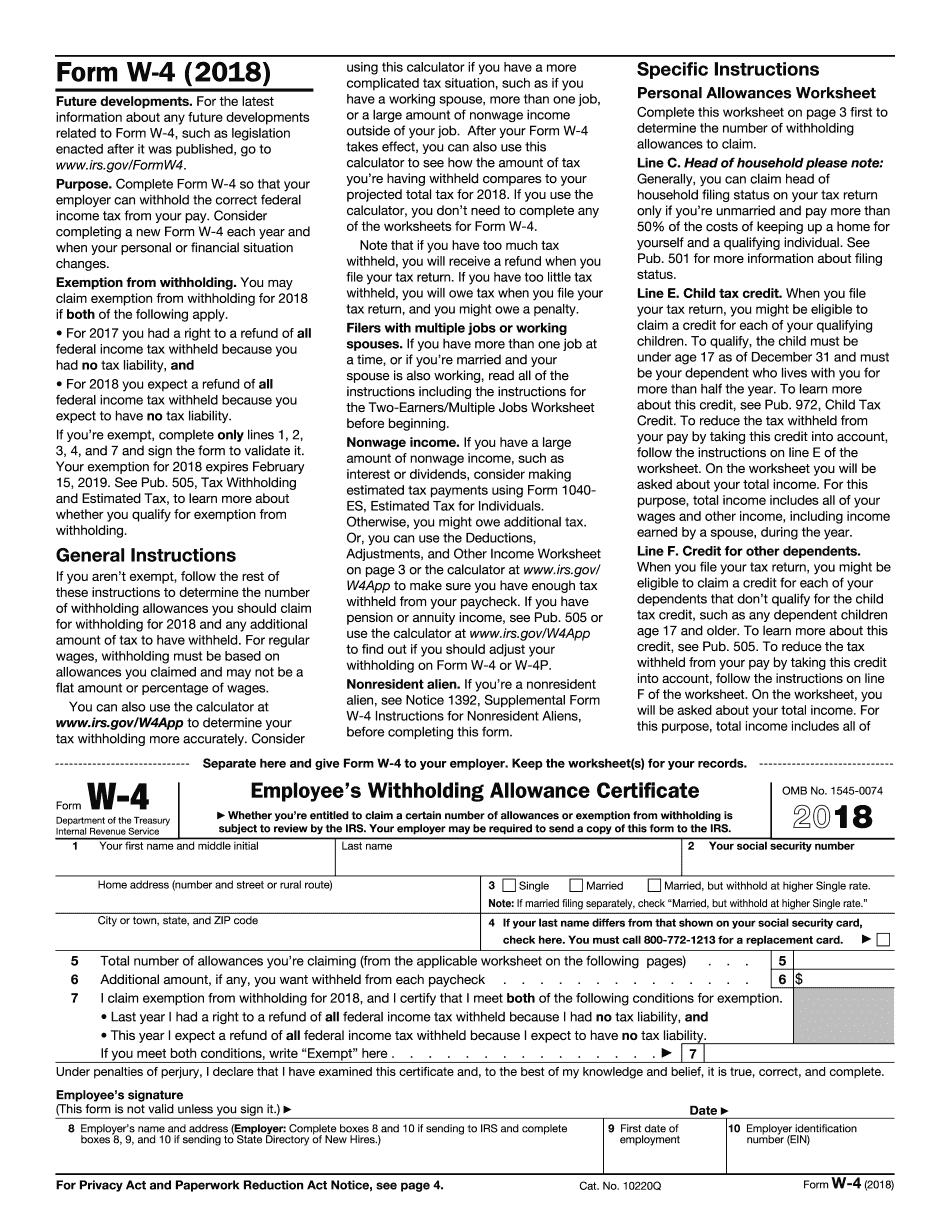

Finally, this image provides a comprehensive guide on how to fill out a W4 2020 form. Follow the instructions carefully to ensure that you’re filling out the form correctly and maximizing your tax savings.

Finally, this image provides a comprehensive guide on how to fill out a W4 2020 form. Follow the instructions carefully to ensure that you’re filling out the form correctly and maximizing your tax savings.